So you’ve taken the plunge. You’ve got your business idea, the fire in your belly, and you’ve even navigated the murky waters of registering your company with the Corporate Affairs Commission (CAC) in Nigeria.

But hold up.

Getting your Certificate of Incorporation is like getting your driver’s license. It’s just the starting point. Now, the real journey begins.

This is where most entrepreneurs stumble. They think registration is the finish line. It’s not. It’s the first step in a marathon.

This guide is your roadmap to dominating the post-incorporation game in Nigeria. We’re going deep on the critical moves you need to make to not just survive, but thrive.

Think of this as your cheat sheet to unlocking growth, avoiding costly mistakes, and building a business that lasts.

What is the Corporate Affairs Commission Post-Incorporation?

Before we start, let’s break down this “Corporate Affairs Commission Post-Incorporation” thing.

It’s simpler than it sounds.

Imagine this: You’ve got a killer business idea. You’re fired up, ready to take on the world. But first, you gotta make it official, right?

That’s where the Corporate Affairs Commission (CAC) in Nigeria comes in.

They’re the ones who give you the stamp of approval, the golden ticket – your Certificate of Incorporation.

Now, most people think that’s the end of the story. Big mistake. Huge.

Getting registered is like getting your driver’s license. It allows you to hit the road, but it doesn’t guarantee you’ll win any races.

Post-incorporation is all about what happens after you get that certificate. It’s about taking the right steps to build a solid foundation for your business. It’s about playing by the rules, staying compliant, and scaling your operations.

Think of it as the difference between building a shack and building a skyscraper. Both might have a roof and walls, but one is built to last, withstand storms, and reach for the sky.

Here’s the gist:

- It’s about taking care of the essentials: Getting your tax ID, opening a bank account, and making sure your company is legally sound.

- It’s about staying compliant: Filing your annual returns, paying your taxes, and keeping your nose clean with the government.

- It’s about scaling your business: Growing your operations, securing funding, and building a team that can help you dominate your market.

- It’s about protecting your business: Safeguarding your intellectual property, having solid contracts, and making sure you’re insured against potential risks.

Bottom line:

Corporate Affairs Commission Post-Incorporation is about transforming your business from a fledgling startup into a well-oiled, unstoppable machine.

It’s about setting yourself up for success, not just survival.

So, if you’re serious about building a business that lasts in Nigeria, you need to master this game.

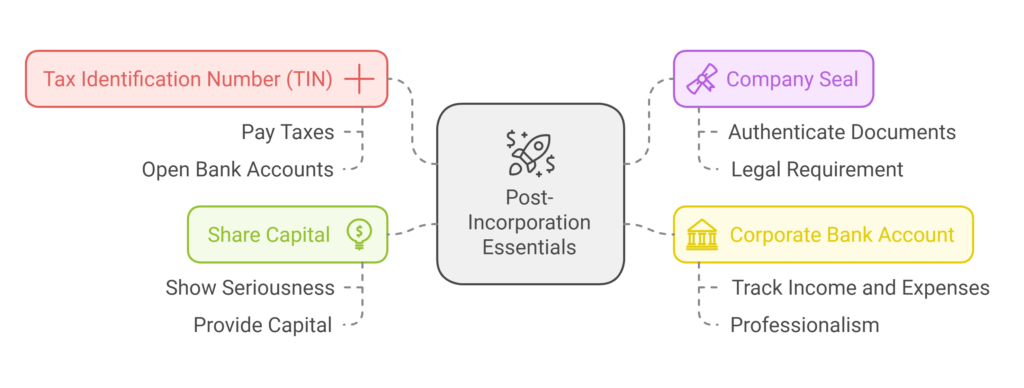

Post-Incorporation Essentials

You’ve got your shiny new company registration.

Awesome!

Now it’s time to build a solid foundation. This isn’t the sexy stuff, but it’s the bedrock of your business. Screw this up, and you’ll be playing catch-up (or worse) down the line.

Here’s the deal:

- Get Your Tax Identification Number (TIN): This is non-negotiable. Think of it as your company’s social security number. You need it to pay taxes, open bank accounts, and basically function as a legitimate business. Head over to the Federal Inland Revenue Service (FIRS) office to get this sorted.

- Nail Your Company Seal: This might seem old school, but it’s still a legal requirement in Nigeria. Your company seal is used to authenticate important documents. Get one made with your company name and registration number.

- Open a Corporate Bank Account: Don’t mix your personal finances with your business finances. It’s a recipe for disaster. Open a separate bank account for your company. This makes tracking income and expenses a breeze, and it looks way more professional when dealing with clients and suppliers.

- Share Capital: Show Me the Money: Remember that share capital you declared during registration? Time to cough up the dough. This shows you’re serious and provides your business with much-needed operating capital.

What to do:

- Don’t procrastinate. Get these essentials sorted ASAP. The longer you wait, the more headaches you’ll have down the road.

- Keep meticulous records. Organize all your incorporation documents, tax receipts, and bank statements. You’ll need them for various purposes, including tax filings and audits.

- Shop around for the best bank. Different banks offer different benefits for businesses. Compare fees, interest rates, and online banking features before making your choice.

Top Tools:

- CAC website: cac.gov.ng (for information and updates)

- FIRS website: firs.gov.ng (for tax-related information and services)

Read also: CAC Name Reservation Pending Approval: What It Means and What to Do Next

Statutory Compliance

Here’s the truth: running a business in Nigeria comes with a whole lot of regulatory requirements.

Ignore them at your peril.

The CAC and other government agencies aren’t playing around. They have the power to slap you with fines, penalties, or even shut you down.

Don’t let that happen.

Here’s the lowdown on staying compliant:

- Annual Returns: Think of this as your yearly check-up with the CAC. You need to file your annual returns, even if your business isn’t active. This report provides updates on your company’s activities, directors, and shareholding structure.

- Company Secretary: Every registered company in Nigeria needs a Company Secretary. This person is responsible for ensuring your company complies with all legal and regulatory requirements. They’re like your compliance guardian angel.

- Meetings and Resolutions: Hold regular meetings of your board of directors and shareholders. Document all decisions and resolutions in writing. This demonstrates good corporate governance and protects you in case of disputes.

- Tax Obligations: Pay your taxes on time. This includes company income tax, value-added tax (VAT), and Pay As You Earn (PAYE) if you have employees. The FIRS has made it easier to file and pay taxes online, so there are no excuses.

What to do:

- Set reminders for deadlines. Don’t miss crucial filing dates. Use a calendar or task management tool to stay on top of things.

- Consider outsourcing compliance. If you’re feeling overwhelmed, hire a professional to handle your statutory compliance. It’s worth the investment for peace of mind.

- Stay informed about changes in regulations. Nigerian laws and regulations can change frequently. Subscribe to newsletters or follow legal experts to stay updated.

Top Tools:

- CAC portal: post.cac.gov.ng (for online filing of annual returns and other post-incorporation filings)

- FIRS e-Tax portal: etax.firs.gov.ng (for online tax filing and payment)

How To Scale Your Business

Alright, you’ve laid the foundation and you’re playing by the rules.

Now it’s time to scale your business. This is where the real magic happens.

But scaling isn’t just about growing your revenue. It’s about building a sustainable and profitable business that can withstand the test of time.

Here’s how to do it:

- Refine Your Business Plan: Your initial business plan was probably a rough sketch. Now it’s time to refine it based on your early experiences and market feedback. A well-articulated plan will guide your growth strategy.

- Secure Funding: Need capital to expand? Explore your options. This could include bank loans, angel investors, venture capital, or even crowdfunding. Prepare a compelling pitch deck and financial projections to attract investors.

- Build a Strong Team: You can’t do everything yourself. Hire talented individuals who share your vision and can contribute to your company’s growth. Delegate tasks effectively and empower your team to make decisions.

- Embrace Technology: Leverage technology to streamline your operations, improve efficiency, and reach a wider audience. This could involve using CRM software, marketing automation tools, or e-commerce platforms.

What to do:

- Focus on your core competencies. Don’t try to be everything to everyone. Identify your strengths and focus on what you do best.

- Build a strong online presence. In today’s digital age, a website and social media presence are essential for any business. Use these platforms to connect with customers, build your brand, and generate leads.

- Don’t be afraid to pivot. The market is constantly changing. Be prepared to adapt your business model or product offerings based on customer demand and industry trends.

Top Tools:

- CRM software: Salesforce, HubSpot, Zoho CRM

- Marketing automation tools: Mailchimp, ActiveCampaign, GetResponse

- E-commerce platforms: Shopify, WooCommerce, Paystack

How To Protect Your Business

You’ve put in the blood, sweat, and tears to build your business. Now it’s time to protect it.

Think of this as your insurance policy against potential threats.

Here’s what you need to know:

- Intellectual Property: Do you have unique products, designs, or branding? Protect your intellectual property through trademarks, patents, and copyrights. This prevents others from ripping off your hard work.

- Contracts and Agreements: Get everything in writing. Use clear and concise contracts with customers, suppliers, and employees. This protects your interests and minimizes the risk of disputes.

- Insurance: Don’t leave your business exposed to risk. Get adequate insurance coverage for your business premises, equipment, and liabilities. This can save you from financial ruin in case of unforeseen events.

- Data Protection: If you collect customer data, you need to comply with data protection regulations. This includes obtaining consent, securing data, and having a clear privacy policy.

What to do:

- Consult with legal professionals. Get expert advice on intellectual property, contracts, and data protection. It’s an investment that can save you a lot of trouble down the line.

- Regularly review your insurance policies. Make sure your coverage is adequate and up-to-date as your business grows and evolves.

- Stay informed about cybersecurity threats. Implement strong security measures to protect your business from cyberattacks and data breaches.

Top Tools:

- Legal directories: Find qualified lawyers specializing in business law.

- Insurance comparison websites: Compare quotes from different insurance providers to find the best deals.

- Cybersecurity software: Antivirus, firewalls, and intrusion detection systems.

Final Thoughts

Remember, success doesn’t happen overnight. It takes hard work, dedication, and a willingness to learn and adapt.

But with the right knowledge and strategies, you can conquer the CAC post-incorporation game and achieve your business goals.

Read also: