Last updated on February 3rd, 2025 at 09:25 am

Nigeria, with its abundant natural resources and growing manufacturing sector, presents numerous opportunities for businesses looking to export goods to the global market.

However, navigating the export process can be complex and requires a thorough understanding of the regulations, procedures, and documentation involved.

This guide provides a comprehensive overview of how to export goods from Nigeria, covering key aspects such as registration, documentation, procedures, financing, logistics, and market opportunities.

Preparing for Export

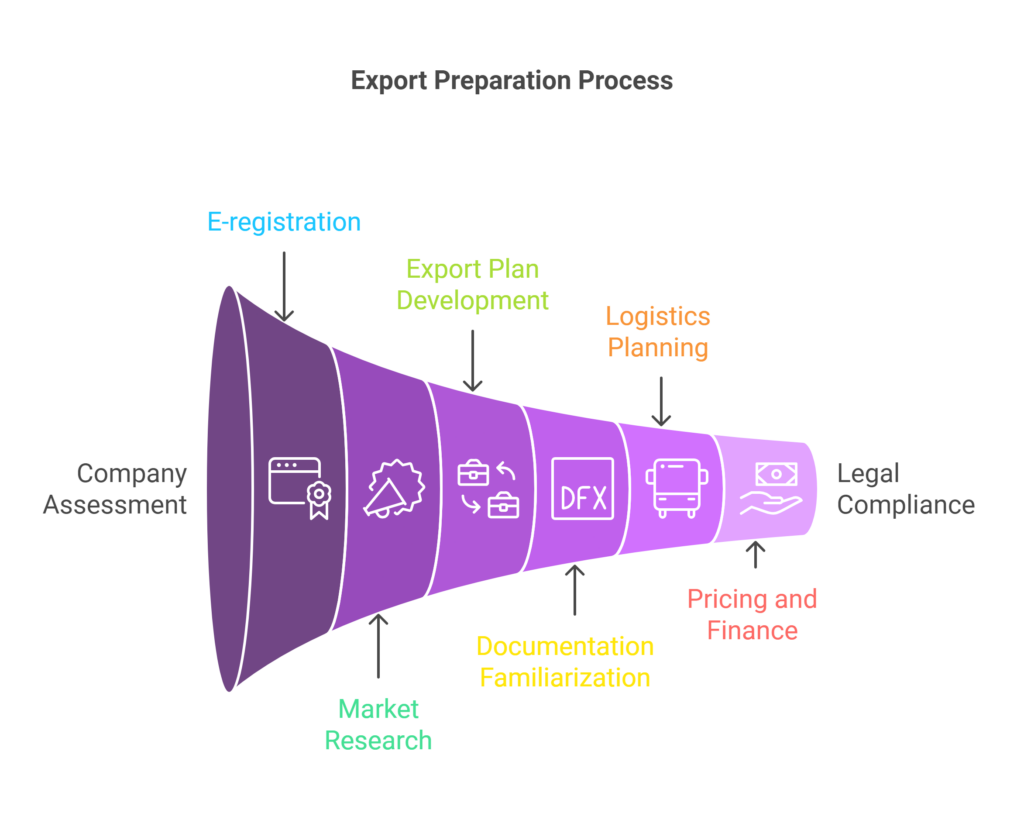

Before delving into the specifics of exporting goods from Nigeria, it’s essential to ensure your business is adequately prepared for this venture.

Exporting involves various considerations, from understanding market demand to complying with legal requirements. Here are nine key steps to help you prepare:

- Export Readiness: Assess your company’s readiness for exporting by evaluating your production capacity, financial resources, and commitment to international trade.

- E-registration: Register your business with the Nigerian Export Promotion Council (NEPC) to obtain the necessary authorization for exporting.

- Understanding the Market: Conduct thorough market research to identify potential export markets, understand buyer preferences, and analyze competition.

- Export Plan: Develop a comprehensive export plan outlining your target markets, export products, marketing strategies, and financial projections.

- Export Documents & Procedures: Familiarize yourself with the required export documentation and procedures to ensure smooth customs clearance and compliance with regulations.

- Logistics & Freights: Understand the different logistics options available and choose the most suitable mode of transport for your goods and destination.

- Export Pricing: Determine appropriate pricing strategies for your export products, considering factors such as production costs, shipping expenses, and market competition.

- Export Finance: Explore available export financing options to secure the necessary funds for fulfilling export orders and managing cash flow.

- Legal Issues: Consult with legal experts to ensure compliance with all relevant laws and regulations related to exporting from Nigeria.

1. Registering as an Exporter with NEPC

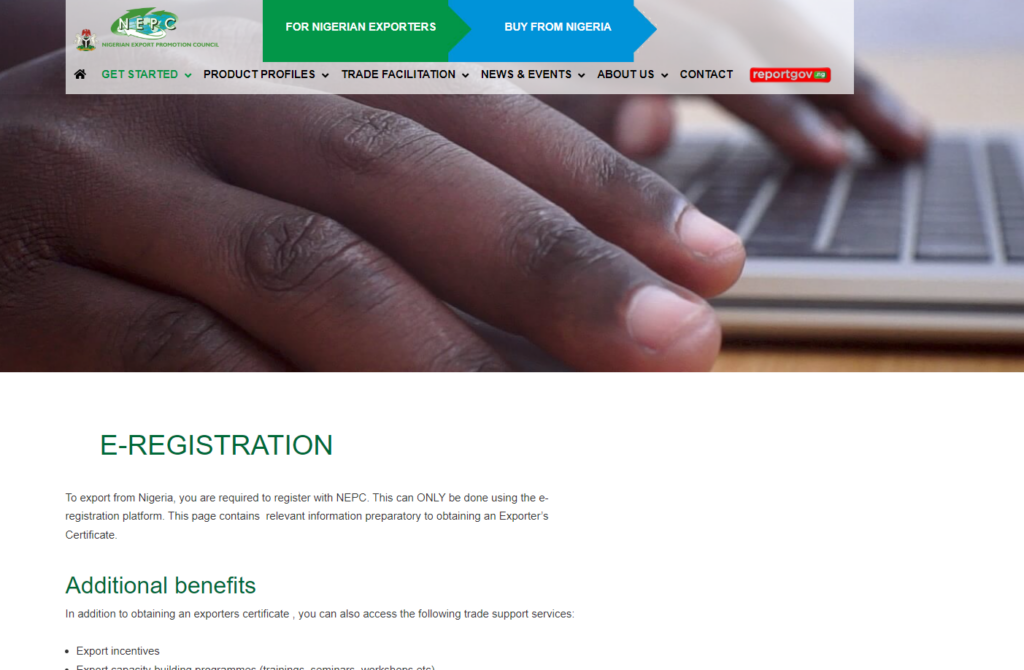

The first step for any business intending to export goods from Nigeria is to register with the Nigerian Export Promotion Council (NEPC).

The NEPC is the government agency responsible for promoting and regulating non-oil exports in Nigeria.

Obtaining an exporter registration certificate from NEPC is a mandatory requirement for exporting from the country.

The NEPC provides valuable guidelines and incentives to support exporters in Nigeria. These resources can be accessed through their official website and publications.

To register with NEPC, businesses need to follow these steps:

- Visit the NEPC e-registration portal: https://nepc.gov.ng/ereg/exporter

- Create an account and complete the online application form.

- Upload the required documents, including:

- Certificate of incorporation

- Federal Inland Revenue Service Endorsed Memorandum of Association

- Certified True Copy of Corporate Affairs Commission – Form 7

- Board resolution to register the company with the NEPC

- Pay the registration fee.

- Upon successful verification of documents and payment confirmation, NEPC will issue an exporter registration certificate.

The NEPC registration certificate is valid for 18 months and must be renewed before expiration.

Read also:

- Latest Corporate Affairs Commission Nigeria Public Search Guide

- Cost of Export License in Nigeria: A Comprehensive Guide

2. Understand HS Codes

The Harmonized System (HS) Codes are a standardized international system of names and numbers used to classify traded products.

These codes are used by customs authorities worldwide to identify products, assess duties and taxes, and gather statistical information.

It is crucial for exporters to determine the correct HS Codes for their goods as it impacts the customs duties and taxes applicable to their shipments.

The first six digits of the HS Code are standardized globally, while countries may add further digits for more specific classifications.

For instance, the United States uses a 10-digit HTS code, which is based on the 6-digit HS code but includes additional digits for US-specific classifications.

Exporters can find the HS Codes for their goods through various resources, including the World Customs Organization website, customs authorities of importing countries, and online databases.

3. Prohibited and Restricted Goods

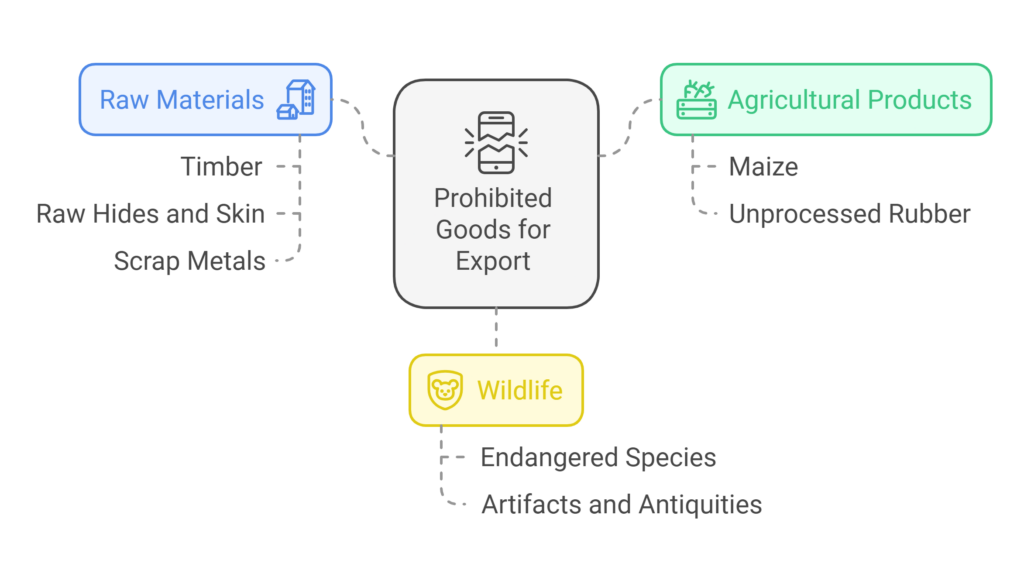

Nigeria has a list of prohibited and restricted goods for export to protect national interests and comply with international regulations.

Exporters must be aware of these restrictions to avoid penalties and ensure compliance with the law.

Prohibited Goods

The following table lists some of the goods prohibited for export from Nigeria:

- Maize

- Timber (rough or sawn)

- Raw hides and skin (including Wet Blue and all unfinished leather) HS Codes 4101.2000.00 – 4108.9200.00

- Scrap Metals

- Unprocessed rubber latex and rubber lumps

- Artifacts and Antiquities

- Wildlife animals classified as endangered species and their products (e.g. Crocodile, Elephant, Lizard, Eagle, Monkey, Zebra, Lion etc.)

- Goods imported can be re-exported

Nigeria’s Export Prohibition & Restriction List

| Category | Prohibited/Restricted Goods | Reason |

| National Heritage & Antiquities | Artifacts, antiques, and cultural treasures deemed to be of national importance. | To preserve Nigeria’s cultural heritage and prevent the loss of valuable historical items. |

| Endangered Species | Live animals, animal parts (e.g., ivory, rhino horns), and plants listed under the Convention on International Trade in Endangered Species of Wild Flora and Fauna (CITES). | To protect endangered species from illegal trade and exploitation. |

| Hazardous Waste | Toxic waste, medical waste, and other hazardous materials. | To prevent environmental damage and protect public health. |

| Weapons & Military Equipment | Firearms, ammunition, explosives, and military vehicles. | To maintain national security and prevent the proliferation of weapons. |

| Drugs & Narcotics | Illegal drugs and narcotics, including cocaine, heroin, and cannabis. | To combat drug trafficking and protect public health. |

| Counterfeit Goods | Fake products that infringe on intellectual property rights, such as counterfeit designer clothing, electronics, and pharmaceuticals. | To protect intellectual property rights and prevent consumer deception. |

| Raw Materials (Restricted) | Certain raw materials, such as timber and minerals, may be subject to export restrictions or quotas. | To conserve natural resources, promote local value addition, and regulate the export of strategically important materials. |

| Agricultural Products (Restricted) | Some agricultural products, such as maize and rice, may be subject to export restrictions or bans during periods of domestic shortage. | To ensure food security within Nigeria and stabilize domestic prices. |

| Unprocessed Agricultural Products | Export of raw, unprocessed agricultural products may be restricted to encourage local processing and value addition. | To promote the growth of the agro-processing industry in Nigeria and increase the value of agricultural exports. |

| Items with Export Duties | Certain goods may be subject to export duties or taxes. | To generate revenue for the government and regulate the export of specific goods. |

| Other Restricted Items | This can include items like rough diamonds (Kimberley Process Certification Scheme), ozone-depleting substances (Montreal Protocol), and certain chemicals and pharmaceuticals. | To comply with international agreements and regulations, protect public health, and prevent the trade of illicit or harmful substances. |

It is essential to consult the official website of the Nigeria Customs Service for the most up-to-date list of prohibited and restricted goods.

4. Export Documentation Requirements

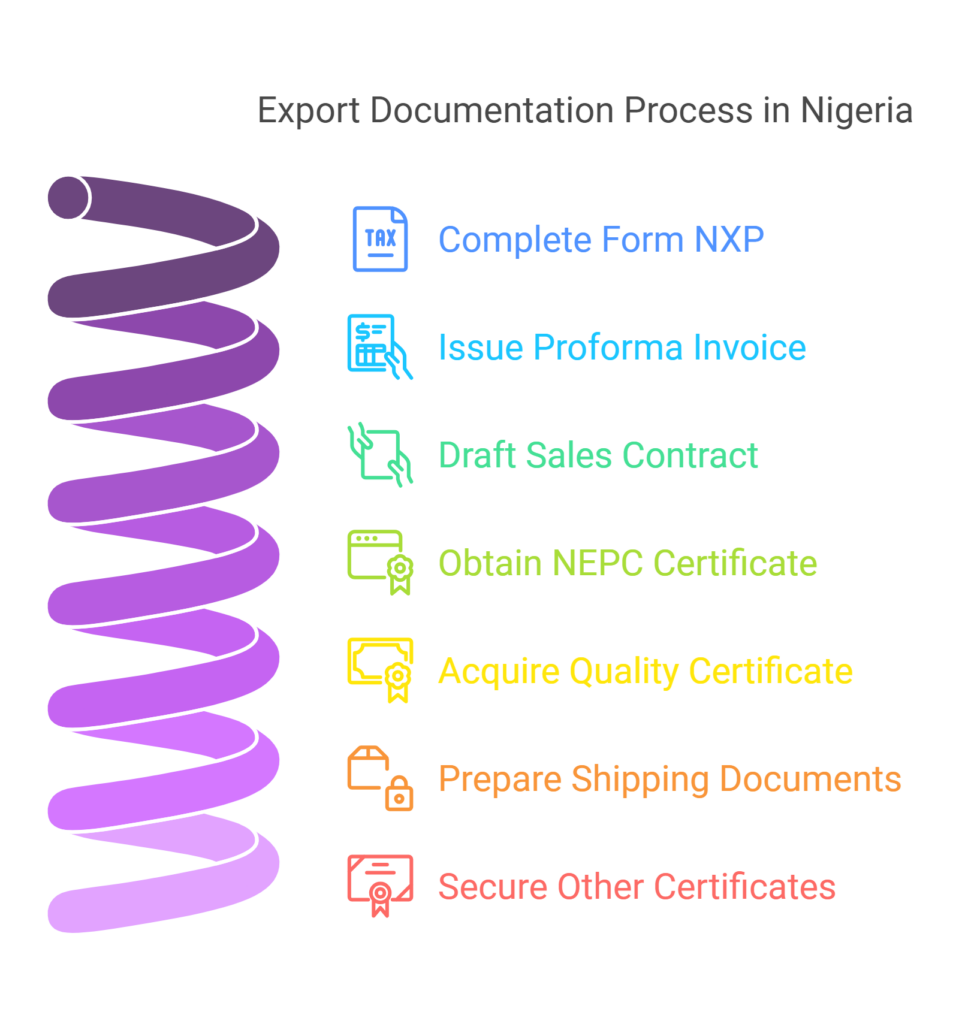

Proper documentation is crucial for smooth customs clearance and successful export transactions. The following are the key export documentation requirements in Nigeria:

- Form NXP: This is a mandatory document completed by the exporter and registered with an authorized dealer bank. It serves as an export declaration and provides information about the goods being exported, the exporter, and the buyer. This form helps ensure the goods meet the buyer’s expectations and comply with export regulations.

- Proforma Invoice: This is a preliminary invoice issued by the exporter to the buyer before the shipment of goods. It provides details about the goods, their quantity, price, and terms of sale.

- Sales Contract/Agreement: This document outlines the terms and conditions of the sale between the exporter and the buyer.

- NEPC Registration Certificate: This certificate is proof of registration with NEPC and is required for all exports from Nigeria.

- Certificate of Quality: Depending on the type of goods being exported, relevant certificates of quality may be required from agencies such as the Standards Organisation of Nigeria (SON) or the National Agency for Food and Drug Administration and Control (NAFDAC).

- Shipping Documents: These include documents such as the Bill of Lading or Air Waybill, which serve as evidence of the contract of carriage between the exporter and the carrier.

- Other Certificates: Depending on the destination country and the type of goods, other certificates such as Certificate of Origin or phytosanitary certificates may be required. For example, a Certificate of Origin may be required to prove the origin of the goods and qualify for preferential tariff treatment.

Exporters should ensure that all documents are accurately completed and submitted to the relevant authorities to avoid delays or rejection of their shipments.

5. Export Procedures

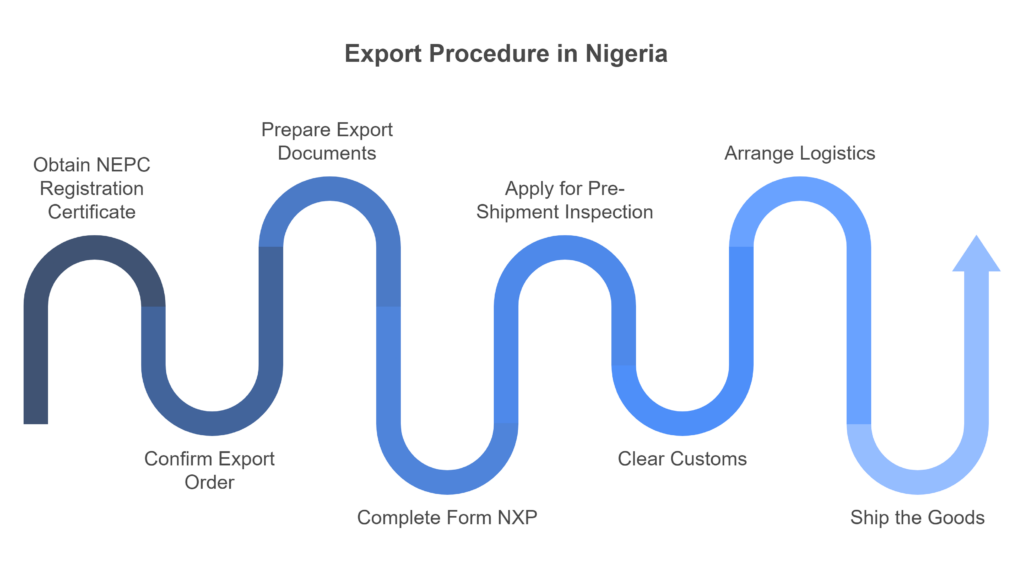

The export procedure in Nigeria involves several steps, from obtaining the necessary documentation to clearing customs and shipping the goods.

Here is a general overview of the export procedures:

- Obtain NEPC Registration Certificate: This is the first and most crucial step for exporting goods from Nigeria.

- Confirm Export Order: Secure a confirmed export order from the buyer, specifying the goods, quantity, price, and delivery terms.

- Prepare Export Documents: Gather all the necessary export documents as outlined in the previous section.

- Complete Form NXP: Complete Form NXP in six copies and register it with an authorized dealer bank. The processing bank retains the first copy, sends the second copy to the Central Bank of Nigeria (CBN), and forwards it to the National Maritime Authority (NMA) after extracting relevant information.

- Apply for Pre-Shipment Inspection: For certain goods, pre-shipment inspection may be required by the government to ensure quality and compliance with standards. This inspection is typically conducted by independent inspection agencies appointed by the government. Exporters need to apply for the inspection and provide the necessary documentation.

- Clear Customs: Submit the completed Form NXP and other required documents to the Nigeria Customs Service for export clearance. This process involves verifying the documents, inspecting the goods (if necessary), and assessing any applicable duties or taxes.

- Arrange Logistics: Engage a freight forwarder to handle the logistics of transporting the goods, including booking cargo space, arranging transportation, and handling customs clearance at the port of exit. Freight forwarders have expertise in international shipping and can help ensure smooth and efficient transportation of goods.

- Ship the Goods: Once customs clearance is obtained, the goods can be shipped to the buyer’s destination.

- Receive Payment: After the goods are delivered and accepted by the buyer, the exporter can receive payment according to the agreed terms.

Opening a Domiciliary Account

To receive foreign currency payments for export transactions, exporters need to open a domiciliary account with an authorized dealer bank in Nigeria. A domiciliary account allows businesses to hold and transact in foreign currencies.

Here are the eight steps involved in obtaining a domiciliary account:

- Obtain forms for a current account.

- Make a deposit.

- Submit documentation.

- Obtain current account number.

- Obtain forms for a domiciliary account.

- Make a deposit.

- Submit documentation.

- Obtain domiciliary account number.

Customs Clearance at Seme Border

For businesses exporting goods through the Seme border with Benin, here are the eight steps involved in obtaining customs clearance:

- Make customs declaration.

- Submit documents to NCS export seat.

- Submit documents to SON.

- Submit documents to NAQS.

- Submit documents to NDLEA.

- Joint examination.

- Obtain customs release.

- Present release documents at the export gate.

6. Export Financing Options

Export financing is crucial for businesses to manage cash flow and fulfill export orders. Several export financing options are available in Nigeria, including:

- Commercial Banks: Commercial banks offer various export financing facilities, such as pre-shipment finance, export credit, and letters of credit. Pre-shipment finance helps cover production and preparation costs before shipment, while export credit provides financing for the buyer to purchase the goods.

- Nigerian Export-Import Bank (NEXIM): NEXIM is a specialized export credit agency that provides a range of financing options to support non-oil exports, including direct lending, export credit insurance, and rediscounting and refinancing facilities. For instance, the Direct Lending Facility provides loans to exporters for up to 80% of the total cost of a project or transaction.

- Central Bank of Nigeria (CBN): CBN offers various export incentive schemes and financing programs to promote non-oil exports. These schemes aim to encourage export diversification and reduce reliance on oil revenue.

- Other Financing Options: These include self-financing, joint ventures, and support from financial institutions and multilateral agencies.

Here is a comprehensive table listing the various costs associated with exporting goods in Nigeria, including their respective ranges:

| Cost Category | Description | Cost Range (₦) | Factors Affecting Cost |

| Pre-Export Costs | Costs incurred before the goods leave Nigeria. | Highly variable | Product: Type, quantity, value. Market: Destination country, distance. Supplier: Sourcing costs, raw materials. Regulations: Licenses, permits, certifications. |

| Product Sourcing | Cost of acquiring the goods you’ll be exporting. Includes raw materials, manufacturing costs, or purchase price from suppliers. | Highly variable – Depends entirely on the product. | Supplier relationships, negotiation skills, bulk discounts, production efficiency. |

| Packaging & Labeling | Cost of packaging materials, labeling, and meeting international packaging standards. | ₦500 – ₦50,000+ per shipment | Product type, packaging requirements, branding, labeling regulations in the destination country. |

| Documentation | Cost of preparing export documents, including commercial invoices, packing lists, certificates of origin, and other required paperwork. | ₦10,000 – ₦100,000+ per shipment | Complexity of documentation, professional fees (e.g., freight forwarders, legal consultants), number of documents required. |

| Inspections & Certifications | Cost of mandatory inspections and obtaining certifications required for your product in the destination country (e.g., phytosanitary certificates for agricultural products, quality certifications). | ₦20,000 – ₦200,000+ per shipment | Product type, destination country regulations, inspection body fees. |

| Local Transportation | Cost of transporting goods from your production facility or supplier to the port of export. | ₦10,000 – ₦500,000+ per shipment | Distance, mode of transport (truck, rail), fuel costs, cargo weight and volume. |

| Export Clearance Costs | Costs incurred at the port of export for customs clearance and other formalities. | ₦50,000 – ₦500,000+ per shipment | Product type, value, customs duties, terminal handling charges, port fees, agency fees. |

| Customs Duties & Taxes | Taxes levied on goods being exported from Nigeria. May vary depending on the product and destination country. | 0% – 20%+ of product value | Government policies, trade agreements, product classification (HS Code). |

| Terminal Handling Charges | Fees charged by the port terminal for handling and storing your cargo. | ₦20,000 – ₦200,000+ per shipment | Cargo weight and volume, storage time, port efficiency. |

| Other Port Fees | Various fees charged by the port authority, including documentation fees, processing fees, and security fees. | ₦10,000 – ₦50,000+ per shipment | Port efficiency, administrative processes, security measures. |

| Freight & Insurance Costs | Costs associated with international shipping and cargo insurance. | Highly variable – Depends on the destination country, shipping method, and cargo value. | Distance, shipping mode (sea, air, courier), fuel costs, cargo weight and volume, insurance coverage, shipping company rates, seasonality (peak seasons may have higher costs), political instability or risks in certain regions can affect insurance premiums. |

| International Freight | Cost of shipping your goods from the port of export to the port of import in the destination country. | Sea Freight: ₦500,000 – ₦5,000,000+ per container. Air Freight: ₦2,000,000 – ₦20,000,000+ per shipment. Courier: ₦50,000 – ₦500,000+ per shipment. | See “Factors Affecting Cost” above. |

| Cargo Insurance | Cost of insuring your goods against loss or damage during transit. | 0.5% – 5%+ of cargo value | Cargo value, shipping route, risk factors (e.g., piracy, political instability), insurance provider. |

| Destination Country Costs | Costs incurred upon arrival in the destination country. | Variable – Depends on the destination country and import regulations. | Import duties, taxes, customs clearance fees, local transportation costs, warehousing costs. |

| Import Duties & Taxes | Taxes levied on goods being imported into the destination country. | 0% – 20%+ of product value | Destination country’s import policies, trade agreements, product classification (HS Code). |

| Customs Clearance | Cost of clearing your goods through customs in the destination country. May involve hiring a customs broker. | ₦50,000 – ₦500,000+ per shipment | Complexity of customs procedures, professional fees (customs broker), efficiency of customs authorities. |

| Local Transportation | Cost of transporting goods from the port of import to the final destination (e.g., warehouse, distributor, customer). | Variable – Depends on distance, mode of transport, and local transportation costs in the destination country. | Distance, mode of transport (truck, rail), fuel costs, cargo weight and volume. |

| Other Costs | This can include warehousing costs, marketing and distribution costs in the destination country, and any other expenses related to selling your product in the foreign market. | Highly variable | Market entry strategy (direct sales, distributors), marketing and advertising costs, storage needs, local regulations, business travel expenses, legal and consulting fees in the destination country. |

Details of Each Cost Type:

- VAT (Value Added Tax): A standard tax applied at 5% of the total value of goods exported.

- Import Tax: This varies widely, typically ranging from 5% to 35%, depending on the nature of the goods being exported.

- Excise Duty: Specifically applicable to certain products like alcohol and tobacco, generally set at 20%.

- NESS Fee: This fee is mandated for all legitimate exports and varies based on the specific product being exported.

- Logistics Costs: These can vary greatly depending on factors such as mode of transportation (air, sea, road) and distance.

- Packaging and Labelling: Costs depend on the complexity of packaging required for the goods being exported.

- Quality Assurance Costs: These are also variable, influenced by the type of goods and any required certifications or inspections.

These costs should be carefully considered by exporters to ensure accurate pricing and compliance with Nigerian export regulations.

Nigeria-Africa Trade and Investment Promotion Program (NATIPP)

The Nigeria-Africa Trade and Investment Promotion Program (NATIPP) is a joint program by the African Export-Import Bank (Afreximbank), NEXIM, and NEPC to promote trade and investment between Nigeria and other African countries.

This program offers financing and support to businesses involved in intra-African trade, helping to boost economic integration within the continent.

Exporters should explore the different financing options available and choose the one that best suits their needs and financial situation.

7. Export Logistics Options

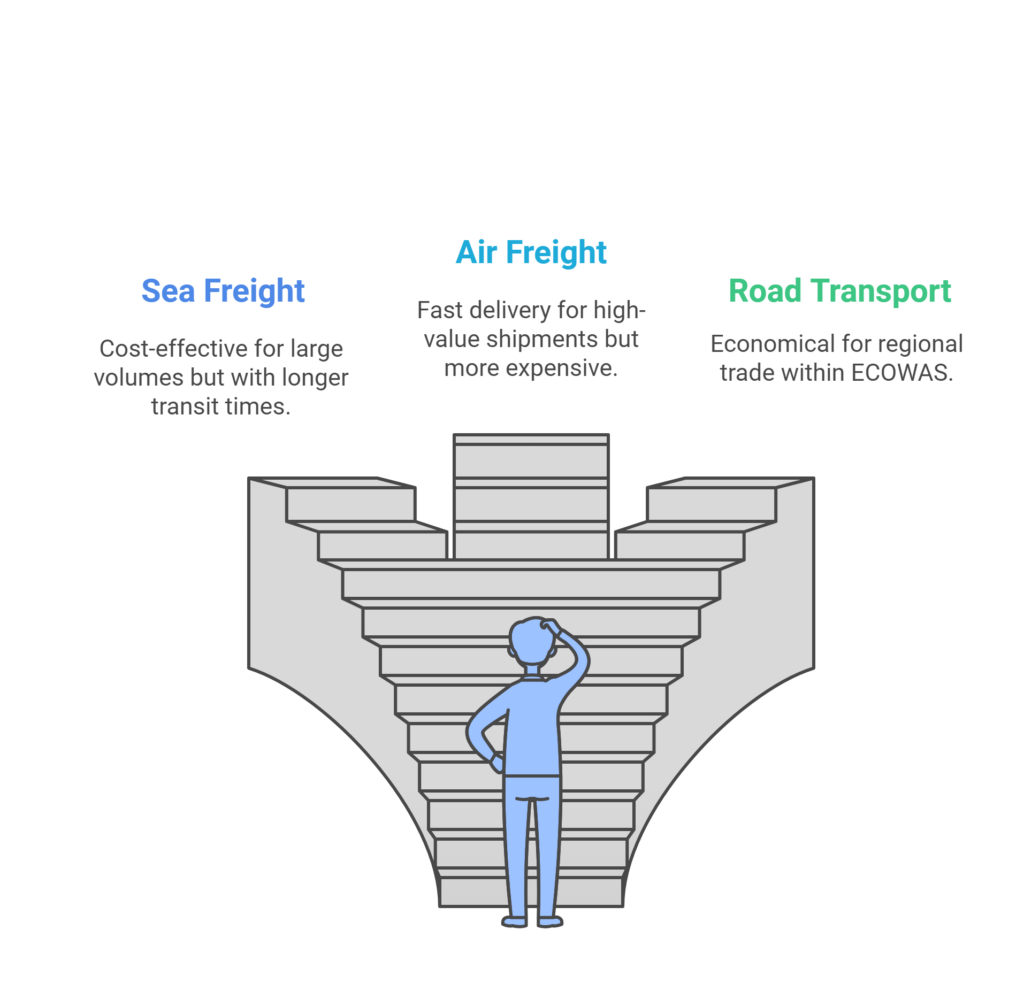

Efficient logistics is essential for timely and cost-effective delivery of goods to the buyer. Nigeria offers various export logistics options, including:

- Sea Freight: Sea freight is the most common mode of transport for large shipments and bulk cargo. Several international shipping lines operate in Nigeria, offering services to various destinations worldwide. It is generally the most cost-effective option for large volumes but has longer transit times.

- Air Freight: Air freight is suitable for smaller, high-value shipments that require faster delivery times. Nigeria has several international airports with cargo handling facilities. While faster than sea freight, air freight is generally more expensive.

- Road Transport: Road transport is mainly used for shipments to neighboring countries within the Economic Community of West African States (ECOWAS). It can be a cost-effective option for regional trade, especially for goods that are not suitable for air transport.

- Courier Services: Courier services like DHL, FedEx, and UPS offer express delivery services for documents and small parcels. They provide fast and reliable delivery but are typically more expensive than other options.

When choosing a logistics option, exporters should consider factors such as the type of goods, destination, delivery time, and cost. For example, perishable goods may require air freight to ensure freshness, while heavy machinery might be best transported by sea.

Incoterms

Incoterms (International Commercial Terms) are a set of standardized trade terms published by the International Chamber of Commerce (ICC).

They define the responsibilities of buyers and sellers in international trade transactions, including who is responsible for costs, risks, and transportation arrangements.

Understanding Incoterms is crucial for exporters to clearly define their obligations and avoid disputes with buyers.

8. Export Market Opportunities

Nigeria has a diverse range of export products with potential markets across the globe.

Before venturing into exporting goods in Nigeria, conduct thorough market research to identify suitable export markets, understand buyer preferences, and analyze competition.

Resources such as online marketplaces, trade fairs, and export promotion organizations can assist in finding buyers and gathering market information.

Some of the key export products from Nigeria include:

- Petroleum Gas: Nigeria is a significant exporter of petroleum gas, with major markets in Europe and Asia.

- Agricultural Products: Nigeria has a vast agricultural sector with export potential for products such as cocoa beans, sesame seeds, cashew nuts, and rubber.

- Solid Minerals: Nigeria is endowed with various solid minerals, including limestone, gold, and iron ore, which offer export opportunities.

- Manufactured Goods: Nigeria’s manufacturing sector is gradually expanding, with potential for exporting products such as textiles, garments, and leather goods.

While crude oil was previously a major export commodity, the government is now encouraging the export of refined petroleum products instead to promote local refining and value addition.

Conclusion

Exporting goods from Nigeria can be a rewarding venture for businesses seeking to expand their reach and tap into the global market.

To succeed in this endeavor, businesses need to be well-prepared and understand the key aspects of the export process.

This includes registering with the NEPC, obtaining the necessary documentation, complying with export regulations, choosing the right logistics options, and conducting thorough market research.

If you can follow the steps outlined in this guide and leverage available resources, you can confidently embark on their export journey and contribute to the growth of Nigeria’s non-oil export sector.

Read also: